Serengeti

Engineering Innovative Structures for Specialty Finance

and Other Special Situation Investments

Engineering Innovative

Structures for Specialty

Finance and Other

Special Situation

Investments

Who We Are

Serengeti is a value-driven opportunistic investment firm that provides sophisticated financing solutions to innovative private companies and their shareholders.

Serengeti was formed in September 2007 by Jody LaNasa. It is a value-driven, opportunistic investment firm specializing in opportunities where assets are hard to source and underwrite, capital solutions require non-traditional terms, and the investment size falls outside the focus of larger credit players. Serengeti’s tailored capital solutions address complex situations through innovative structuring and creative approaches, with a strong focus on the technology and defense sectors.

![]()

In 2024, Serengeti and Kyle Bass’ firm, Hayman Capital Management, launched Rochefort Asset Management, a Serengeti-affiliated advisor approved by and working with the Department of Defense and Small Business Administration to finance the growth of businesses critical to our country’s national and economic security.

Insights

PRESS RELEASE • FEB 12, 2026

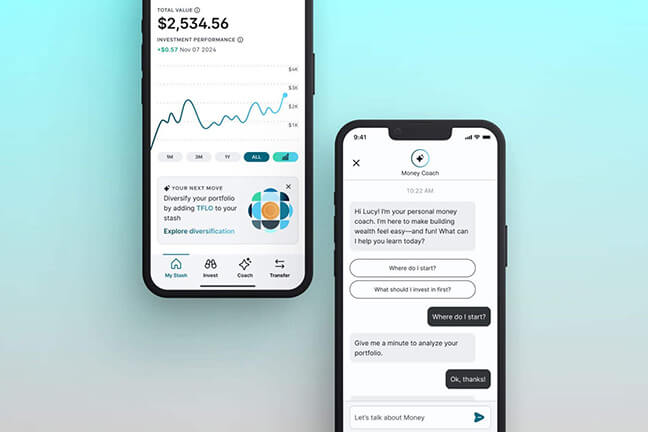

Grab Accelerates Financial Services Roadmap with Acquisition of Digital Investing Platform, Stash Financial, Inc.

NEWS • FEB 9, 2026

UiPath Acquires WorkFusion, Strengthening Agentic Solutions for Financial Services